Konstantin Tserazov: Neobanking in the UAE in search of growth points

Neobanks are often unburdened by complex and costly legacy IT systems, allowing them to approach the development, piloting, and scaling of new products more flexibly. Consumers, in turn, benefit from improved service quality and speed, as well as often receiving more attractive service conditions.

The neobanking market is developing in almost all regions of the world. Neobanks are primarily focused on expanding their customer base in national or regional markets and rarely engage in large-scale global expansion. There are currently no major global players, primarily due to the need for significant investments and the complexity and differentiation of industry regulations in different countries.

In the UAE, neobanking is a new emerging and rapidly growing market. Despite its relatively small population (10+ million) and the presence of around 50 banks in the country, the fintech industry, including neobanking, is actively supported at the government level. As early as 2020, the UAE Central Bank established the FinTech Office, which collaborates with businesses to develop an innovative financial ecosystem.

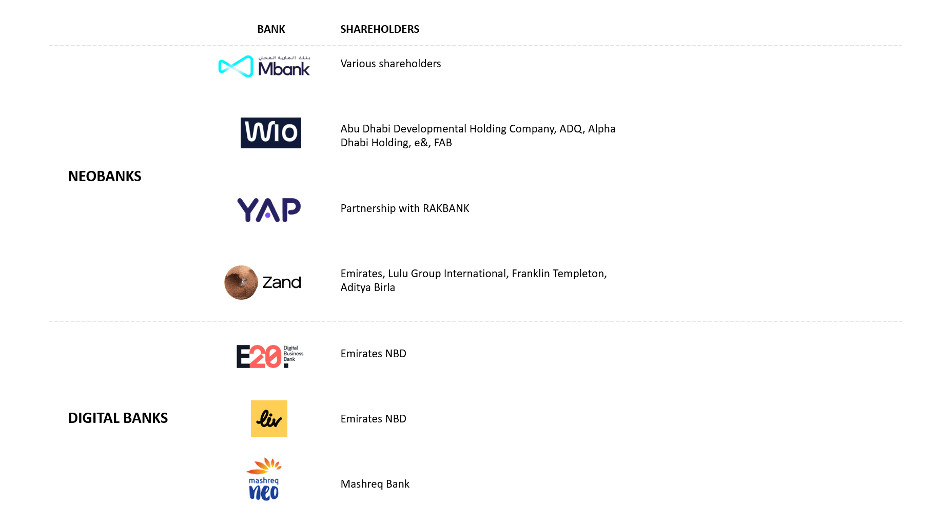

In the neobanking market, two types of banks are distinguished (in addition to traditional banks):

• Neobanks: These are fully digital banks that do not have physical branches and rely on funds raised from investors.

• Digital banks: These banks have a similar business model to neobanks but are typically established by existing players in the industry.

Key neobanks and digital banks in the UAE Overall, there are around 40 neobanks operating in the Middle East, with over 10 neobanks launched between 2021 and 2023. The UAE has the most rapidly developing market, with approximately a quarter of all neobanks in the Middle East being established in the UAE. In the past 2-3 years alone, neobanks such as Zand, Yap, Wio, and Bankiom have emerged in the UAE. Currently, neobanks in the UAE are focused on building their customer base and creating a sustainable business model, with only a few success stories to highlight. One notable success is Wio Bank, which began operations in September 2022 with the launch of the Wio Business service, targeting small and medium-sized enterprises (SMEs) and providing platform solutions, including Banking-as-a-Service (BaaS). In its first year, the company managed to attract over 45,000 SME clients. Among the benefits offered to customers are savings interest rates, free processing of salary transfers, and a fixed exchange rate for the US dollar. In September 2023, the company launched its second product, Wio Personal, for individuals. Using the Emirates ID, customers can open a bank and investment account within the application. The app’s functionality allows users to assess their financial health, analyze expenses, and ultimately make more informed financial decisions. Existing banks are also developing innovative business models by creating their own neobanks: Mashreq Neo (Mashreqbank), Liv (Emirates NBD), Amwali (ADIB). With the advantage of scale and investment capital, established players find it easier to scale in the neobanking market. A notable example is Liv Bank, positioning itself as a lifestyle bank for the young Generation Y and Z. Among the company’s innovative products are a debit card for children, a loyalty program with gamification elements (offering customers up to 3% of their salary deposits as a bonus), and the ability to flexibly switch between different reward programs (such as airline miles and cashback). Since its launch in 2017, Liv Bank’s customer base has already approached 700,000. The drivers of digital banking development in the UAE are favorable demographics (a high proportion of young population who are adept at and fond of using new technologies), government support (creating a favorable regulatory environment and investment infrastructure), and access to technology (major international IT and financial companies actively conducting business in the UAE). Additionally, the UAE is a country of immigrants who send significant amounts of their earnings abroad (up to $50 billion per year), creating a demand for high-quality and convenient services for international transfers. Penetration of neobanking by country, 2022 and 2027 Among the restraining factors that can influence the development of neobanking in the UAE, the following can be highlighted: • Service spectrum: Although neobanks provide convenient interfaces, their product offerings are often limited compared to traditional banks. Neobanks focus on basic banking services such as payment solutions, deposits, credit cards, and money transfers. For more complex services (such as mortgages), customers still have to turn to traditional banks. • Personal interaction: In the MENA markets, personal interaction is extremely important. Therefore, in the B2B segment (such as corporate lending), the absence of physical branches is not a competitive advantage. Considering that a significant portion of lending in the UAE (up to 70%) is corporate lending, the available market volume for neobanks is significantly reduced. • Trust: Customers may be skeptical of services provided by new players and prefer to keep their savings in organizations that have been in the market for a long time and have a reputation. The most likely scenario for the development of neobanking in the UAE is the democratization of the market, influx of new players, and an increased role of partnership infrastructure. Neobanks are more likely to complement rather than replace existing players, focusing on specific niches and addressing specific customer pain points. According to forecasts, the penetration of neobanking among the adult population in the UAE is expected to increase to 41% by 2027 (compared to 19% in 2022), which is higher than in major financial centers such as the United States (15% by 2027), Germany (24%), and Singapore (35%). Author — Konstantin Tserazov, former Senior Vice President of Otkritie Bank